International Immersion Programme (IIP)

FORE School of Management (FSM) organizes International Immersion Programmes (IIP) annually as a complimentary part of all its full-time Post-Graduate Diploma in Management (PGDM) programmes. It is a compulsory part of the curriculum of PGDM, PGDM (International Business), PGDM (Financial Management) and PGDM (Big Data Analytics). The IIP is held in the first-year (preferably in Term-3) of the PGDM programmes at different international locations with our international partner institutions. The objective of the programme is to provide students wholesome and experiential learning through an exposure to international business scenarios and global best practices in their respective areas of specialization. The immersion involves 15 hours of in-class course spread over 5-days in an elective of choice along with industrial, corporate, and experiential learning visits at any one of the international partner institutions abroad.

The International Immersion Programme is subject to the safe international traveling conditions during the period of travel and the Institute reserves the right to cancel the same in a pandemic like situation. The decision of choice of an international location/institution for the IIP for each PGDM elective is of the institution (FSM) and final.

IIP of the PGDM (IB) students at the ESSEC Business School, Paris, France.

The International Immersion Programme (IIP) for 120 students of PGDM (IB) Batch-18 was held at the ESSEC Business School, Paris from September 21 to 27, 2025. The courses delivered to students were: 1. “Negotiation Strategies for Global Business” by Prof. Alex Issa; 2. “International Trade and Global Perspective” by Prof. Ashok Som & Prof. Marc O. Strauss Kahn. Some of the glimpses of the IIP at ESSEC Business School, Paris are as follows:

IIP of the PGDM (BDA) students at the SDA Bocconi School of Management, Milan, Italy.

The International Immersion Programme (IIP) for 180 students of PGDM (BDA) Batch-05 was held at the SDA Bocconi School of Management, Milan, Italy, from June 23 to 26, 2025. The course delivered to students was “Blockchain and Crypto Assets”. The 5-day International Immersion Programme (IIP) at SDA Bocconi School of Management Milan, Italy, offered a powerful blend of academic rigour, real-world insights, and cross-cultural learnings. Some of the glimpses of the IIP at SDA, Milan are as follows:

IIP of the PGDM (FM) students at the Frankfurt School of Finance and Management, Frankfurt (Germany).

The International Immersion Programme (IIP) for 180 students of PGDM(FM) Batch-07 was held at the Frankfurt School of Finance and Management from June 9 to 13, 2025. The courses delivered to students were: 1. “Innovative Financing Mechanism for Development” by Mr. Christian Hecker; 2. “Blended Finance for Development Projects” by Mr. Helmut Grossmann. 3. “Mergers and Acquisitions, with a focus on Cross-Border Transactions by Mr. Oliver Böhm”. Some of the glimpses of the IIP at the Frankfurt School of Finance and Management, Frankfurt are as follows:

IIP of the PGDM students at the Nanyang Technological University (NTU), Singapore.

The International Immersion Programme (IIP) for 180 students of PGDM Batch-33 was held at NTU, Singapore, from June 9 to 13, 2025. The courses delivered to students were: 1. “Talent Management in Asia” by Prof. Olexander Chernyshenko; 2. “Consumer Neuroscience & Neuromarketing” by Prof. Gemma Calvert; 3. “Strategic Edge: Transient Advantage, Dynamic Arenas, Dual Transformation & Ecosystems by Prof. Tan Joo Seng.” Some of the glimpses of the IIP at NTU, Singapore are as follows:

IIP of the PGDM students at RMI-NUS, Singapore.

The International Immersion Programme (IIP) of 120 students of PGDM Batch-33 was held at RMI-NUS, Singapore during 24th March to 28th March 2025. The courses delivered to students were: 1. “Introduction to Quantitative Investing” by Prof. Chen Kan; 2. “Sustainable Finance Risk Management” by Prof. Max Wong. Some of the glimpses of the IIP at RMI-NUS, Singapore are as follows:

IIP of the PGDM(IB) students at ESSEC, Paris

The International Immersion Programme (IIP) of the PGDM(IB) Batch-17 students was held at ESSEC Business School (ESSEC), Paris during 30th September 2024 to 4th October 2024. The two different specialized half-credit (15 hours) courses delivered to students were: 1. “International Trade and Global Perspective” by Prof. Ashok, Prof. Dominique Simpson-Jones and Prof. Marc-Olivier Strauss-Kahn; 2. “Negotiation Strategies for Global Business” by Prof. Alex Issa. Some of the glimpses of the IIP at ESSEC, Paris are as follows:

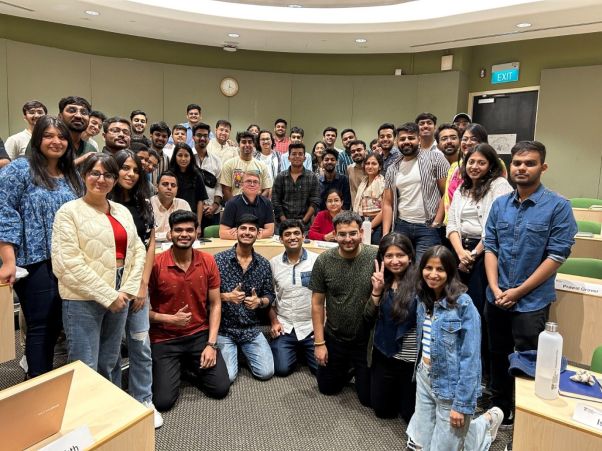

FORE School of Management’s PGDM (BDA) students bid goodbyes after an incredible and insightful International Immersion Program at NUS, Singapore (2024).

FORE School of Management’s PGDM (BDA) students bid goodbyes after an incredible and insightful International Immersion Program at NUS, Singapore. Thanks to the NUS faculty and staff for this enriching experience and broadening perspectives, local to global. Until next time, world!

Global Learning in Action! Our FORE School of Management students, on their NUS industrial visit under the International Immersion Program (2024)

Global Learning in Action! Our FORE School of Management students, on their NUS industrial visit under the International Immersion Program, visited NEWaters, the largest water recycling plant in Singapore. They gained insights into industry practices and interacted with faculty and plant representatives.

Our campus is already buzzing with the business insights and global perspectives they will bring back from NTU, Singapore (2024).

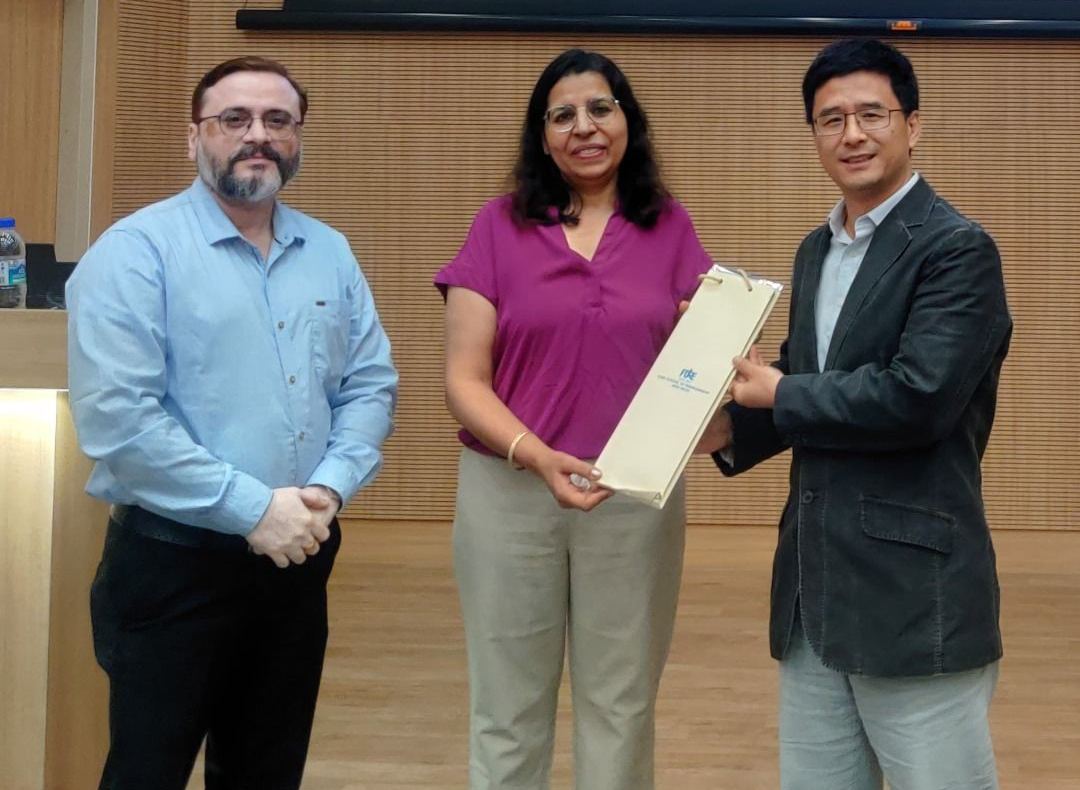

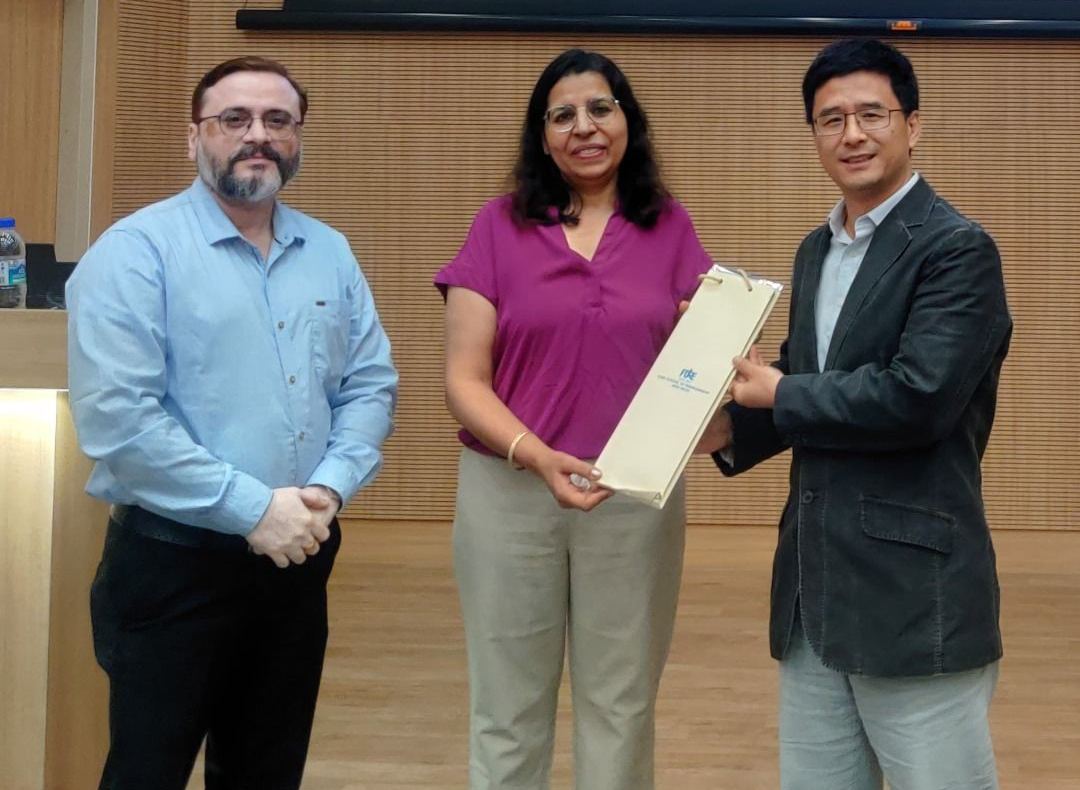

It’s a wrap for FORE School of Management’s International Immersion Program, and our campus is already buzzing with the business insights and global perspectives they will bring back from NTU, Singapore. The last class during their IIP tour was on ‘Blue Ocean Strategy’. The IIP concluded with a vote of thanks from Professor Tan Joo Seng from NTU, in the presence of our internal faculty, Prof. Vandana Gupta and Prof. Aditya Banerjee.

It’s the concluding day of FSM’s International Immersion Program (2024)

It’s the concluding day of FSM’s International Immersion Program!

We express our sincere gratitude to the faculty and staff for their commendable support and crucial insights from classrooms, industrial visits, and more. It was a captivating experience for the FOREians there.

IIP of the PGDM (Batch 31) at Nanyang Business School (NBS), Nanyang Technological University (NTU), Singapore

The IIP of the PGDM Batch-31 was held at Nanyang Business School (NBS), Nanyang Technological University (NTU), Singapore during 24 – 28 April, 2023. The three different specialized half-credit (15 hours) courses delivered to students at NTU were: 1. “Blue Ocean Strategy” taught by Prof. Tan Joo Seng; 2. “Consumer Neuroscience and Neuromarketing” by Prof. Gemma Calvert; and 3. “Global Human Resource Management” by Prof. Olexander Chernyshenko (Sasha). Some of the glimpses of the IIP at NBS, NTU are as follows:

IIP of the PGDM-IB (Batch 16) at Rochester Institute of Technology, Dubai (UAE)

The IIP of the PGDM(IB) Batch-16 was held at Rochester Institute of Technology, Dubai (UAE) during 24 – 28 April, 2023. The two different specialized half-credit (15 hours) courses delivered to students were: 1. “International Trade: A Global Perspective” by Dr. Roger Griffiths and Dr. Sanjay Modak; 2. “Planning and Negotiating Strategies for Global Business” by Dr. Fabio Puntillo and Dr. Petya Koleva. The students have also visited the experiential learning sites such as the Masdar City (the world’s most sustainable urban community), a first-hand experience of driver less mobility, and an expert session on Business and Sustainability at Siemen Energy headquarters at Abu Dhabi; and Futuristic Technologies industrial visit at the Sharjah Research, Technology, and Innovation Park. Some of the glimpses of the IIP at Dubai, Abu Dhabi and Sharjah are as follows:

IIP of PGDM-FM (Batch 5) at the Frankfurt School of Finance and Management, Frankfurt (Germany)

The IIP of the PGDM(FM) Batch-05 was held at the Frankfurt School of Finance and Management (FSFM), Frankfurt (Germany) during 24 – 28 April, 2023. Under the programme, students undertook a half-credit (15 hours) course on “International Financial Management” delivered by Prof. Uwe Wystup. A glimpse of the IIP of PGDM (FM) at FSFM, Germany is as follows:

IIP of PGDM-BDA (Batch 3) at the Risk Management Institute (RMI), National University of Singapore (NUS), Singapore

The IIP of the PGDM(BDA) Batch-03 was held at the RMI, National University of Singapore, Singapore during 24-28 April, 2023. The course on “Analytics and Project Management” was delivered to students by Dr. Cai Yuhao. A glimpse of the IIP of PGDM (BDA) at the RMI, NUS, Singapore is as follows: